Transportation Utility

|

properties with pending special assessment charges

To see if you will not be charged your pending special assessment, please see the accepted resolution HERE. In the coming weeks, a formal letter will be sent to each of the properties that were noticed of pending special assessment charges. |

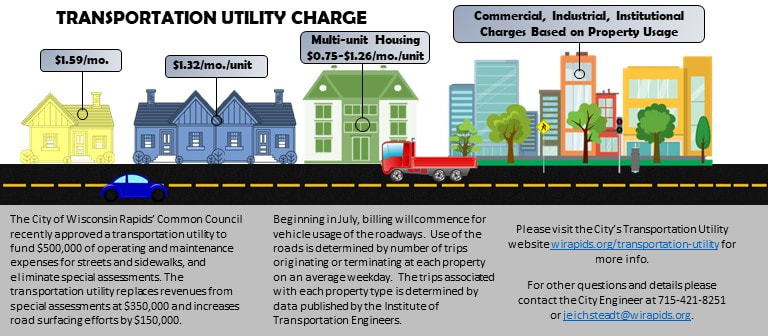

In response to concerns around special assessments, the Common Council selected a transportation utility model to fund $500,000 of operating and maintenance expenses for streets and sidewalks, and eliminate special assessments. The utility would disperse the cost across all property owners in the city equitably, to ensure the properties creating the most traffic are paying a fair share. Under the previous system, all property owners (including nonprofits) are subject to special assessments, because street maintenance and improvements directly benefit property owners. However, those costs were disproportionately high for residential property owners.

On April 14, 2022, the Common Council voted in favor of the transportation utility and billing for the new utility may start as soon as July 2022. See the press release HERE. Click HERE for the Transportation Utility Ordinance.

Questions?

Call, email or schedule an appointment to meet with City Engineer Joe Eichsteadt at 715-421-8251 or [email protected] |

Press Releases

City Meetings

Review and Decisions Regarding Transportation Utility

Review and Decisions Regarding Transportation Utility

April 19th, 2022

The Common Council discussed and voted in favor of the proposed transportation utility ordinance.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

March 15th, 2022

The Common Council discussed the proposed transportation utility ordinance, and reviewed proposed changes to current special assessment

ordinances in Chapters 5 and 6.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

March 14th, 2022

The Public Works Committee reviewed the proposed transportation utility ordinance, and reviewed proposed changes to current special assessment

ordinances in Chapters 5 and 6.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

March 3rd, 2022

The Public Works Committee reviewed the proposed transportation utility ordinance, and reviewed proposed changes to current special assessment ordinances in Chapters 5 and 6.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

February 15th, 2022

The Common Council reviewed and set the preliminary target revenue amount for the transportation utility.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

February 3rd, 2022

The Public Works Committee reviewed and set the preliminary target revenue amount for the transportation utility.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

December 7th, 2021

The Public Works Committee voted in favor of prioritizing transportation utility development work over special assessment administration.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

October 19th, 2021

The Common Council discussed transportation utility next steps, and voted in favor of completing the transportation utility database and delaying action on

the proposed ordinance until the database is complete.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

October 5th, 2021

The Finance and Property Committee accepted a professional services agreement from raSmith on a time and materials basis to work with City staff to refine the transportation utility model, complete the database, and work on connecting the data with utility accounts.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

September 21st, 2021

There was a public hearing on the proposed transportation utility at the September 21st Common Council meeting.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

September 7th, 2021

The Public Works Committee reviewed and discussed transportation utility ordinance language. The Public Works Committee voted in favor of accepting proposed transportation utility ordinance, with these changes and details:

Documents discussed in the meeting:

July 6th, 2021

The Public Works Committee reviewed and discussed draft ordinance language and outlined a possible scope of public outreach for the transportation utility.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

June 28th, 2021

The Public Works Committee and Common Council Committee of the Whole met jointly to discuss questions and decide next steps for the transportation utility.

Learn more here: Meeting Agenda, Recording of Meeting, Meeting Minutes

Documents discussed in the meeting:

June 8th, 2021

The Public Works Committee met for a question and answer discussion on the transportation utility.

Learn more here: Meeting Minutes, Recording of Meeting, Q&A

June 1st, 2021

The Public Works Committee received an update on the transportation utility.

Learn more here: Meeting Minutes, Recording of Meeting, Presentation

May 4th, 2021

The Public Works Committee and Common Council Committee of the Whole met jointly to view a public presentation by Ehlers/raSmith.

Learn more here: Meeting Packet, Meeting Minutes, Recording of Meeting, Presentation

The Common Council discussed and voted in favor of the proposed transportation utility ordinance.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

March 15th, 2022

The Common Council discussed the proposed transportation utility ordinance, and reviewed proposed changes to current special assessment

ordinances in Chapters 5 and 6.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

March 14th, 2022

The Public Works Committee reviewed the proposed transportation utility ordinance, and reviewed proposed changes to current special assessment

ordinances in Chapters 5 and 6.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

March 3rd, 2022

The Public Works Committee reviewed the proposed transportation utility ordinance, and reviewed proposed changes to current special assessment ordinances in Chapters 5 and 6.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

February 15th, 2022

The Common Council reviewed and set the preliminary target revenue amount for the transportation utility.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

February 3rd, 2022

The Public Works Committee reviewed and set the preliminary target revenue amount for the transportation utility.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

December 7th, 2021

The Public Works Committee voted in favor of prioritizing transportation utility development work over special assessment administration.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

October 19th, 2021

The Common Council discussed transportation utility next steps, and voted in favor of completing the transportation utility database and delaying action on

the proposed ordinance until the database is complete.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

October 5th, 2021

The Finance and Property Committee accepted a professional services agreement from raSmith on a time and materials basis to work with City staff to refine the transportation utility model, complete the database, and work on connecting the data with utility accounts.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

September 21st, 2021

There was a public hearing on the proposed transportation utility at the September 21st Common Council meeting.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

September 7th, 2021

The Public Works Committee reviewed and discussed transportation utility ordinance language. The Public Works Committee voted in favor of accepting proposed transportation utility ordinance, with these changes and details:

- Remove section 51.13 Inspection of Premises.

- The City Engineer would lead the transportation utility (instead of the Public Works Director).

- The transportation utility ordinance would be introduced at the September 21st Common Council meeting.

- The Common Council would take action on the ordinance at the October 19th Common Council meeting.

Documents discussed in the meeting:

- Wisconsin Rapids Transportation Utility Feasibility Analysis, 08/30/2021

- Transportation Utility Ordinance Referral

- Draft Transportation Utility Ordinance

- 2022 Projected Debt Service, No Changes

- 2022 Projected Debt Service, With Transportation Utility

July 6th, 2021

The Public Works Committee reviewed and discussed draft ordinance language and outlined a possible scope of public outreach for the transportation utility.

Learn more here: Meeting Packet, Recording of Meeting, Meeting Minutes

June 28th, 2021

The Public Works Committee and Common Council Committee of the Whole met jointly to discuss questions and decide next steps for the transportation utility.

Learn more here: Meeting Agenda, Recording of Meeting, Meeting Minutes

Documents discussed in the meeting:

- This alternate rate model keeps maintenance activity budgets in the general fund but adds $450,000 in the Utility for resurfacing projects. This is the model that the Public Works Committee is currently recommending. It eliminates routine special assessments for street reconstruction projects, eliminates borrowing for routine street reconstruction projects, and allows for about .5-1.0 miles of additional resurfacing annually (allowing the City to take a step forwards towards transportation sustainability).

- The streets-by-year graph shows miles of street by age. Ideally we should have about 30 miles of streets in each column. This graph is a little misleading because divided 4-lane roadways are measured twice. We have 150 total miles of streets, not 170.

June 8th, 2021

The Public Works Committee met for a question and answer discussion on the transportation utility.

Learn more here: Meeting Minutes, Recording of Meeting, Q&A

June 1st, 2021

The Public Works Committee received an update on the transportation utility.

Learn more here: Meeting Minutes, Recording of Meeting, Presentation

May 4th, 2021

The Public Works Committee and Common Council Committee of the Whole met jointly to view a public presentation by Ehlers/raSmith.

Learn more here: Meeting Packet, Meeting Minutes, Recording of Meeting, Presentation

City's Review of Funding Options to Offset Street Construction and Maintenance Costs

|

Current program

The cost to property owners are based on lineal feet of frontage along the improvement project and includes a variety of improvement types. Each of the improvements is assessed based upon cost percentages identified in the City’s ordinances and policies. Property owners are assessed: 0% of cost of replacement sanitary sewer main 0% of cost of replacement water man 20% of cost of pavement 66.6% of cost of curb and gutter 100% of cost of sidewalk 100% of cost of new or replacement sanitary leads and water services Revenue Approximately $350,000 per year. Pros

Cons

vehicle registration fee

State law permits any municipality or county to adopt an ordinance that imposes a flat, annual vehicle registration fee, or “wheel tax,” on automobiles and trucks of not more than 8,000 pounds customarily kept within that jurisdiction. Vehicles may be subject to both a municipal and a county fee. All vehicles exempt from the state fee are also exempt from local fees. There is no limit on the amount of the fee. The Wisconsin Department of Transportation (WI DOT) collects the fee when the annual state registration fee is paid. WI DOT retains 17 cents per registration for administrative costs. The rest of the fee is remitted to the jurisdiction imposing the fee. Revenues from the wheel tax must be used for transportation related purposes. See Wis. Stat. § 341.35(6r). Revenue According to the WI DOT’s website, there are 19,933 vehicles registered in the City of Wisconsin Rapids that are eligible for the registration fee. Revenue Potential:

Pros

transportation utility

Transportation Utility Fees (TUF) raise revenue through the creation of a transportation utility, similar to a public electric, sewer/water, or stormwater utility. Much like other public utilities, a transportation utility charges fees based on a customer’s relative use of the utility. In other words, under a TUF, residents, public organizations, and businesses would pay a fee based on the amount of traffic they generate within the municipality’s transportation/street system. Revenue A transportation utility presents an equitable way for the City to secure the needed funds from infrastructure users via fee-based methodology. Just as other utilities charge fees based on use, so would a transportation utility. The revenue collected through a transportation utility can be incremented through the annual budget process to either offset the current special assessment revenue OR increase funding to move toward a more sustainable street replacement program. Pros

Cons

general property tax increase

Special Assessments would cease under this alternative, and an increase in the general property taxes would occur to close the funding gap for street projects. All taxpayers would be contributing, but would not include tax-exempt properties from contributing toward road infrastructure improvements. In considering this option and the need to offset $350,000 in revenue from special assessments there would be a tax rate increase of about 0.00033 which would change the local mill rate from 0.01209 to 0.01242. As an example, to a residential property with a $100,000 home value, the property taxes would increase by $33 per year. In order to implement this option, a levy limit referendum with voter approval would be required to raise taxes by an equivalent amount currently obtained by special assessments. Revenue The revenue collected through a tax rate increase can be incremented to either offset the current special assessment revenue OR increase funding to move toward a more sustainable street replacement program. Pros

Cons

payment in lieu of taxes (pilot) for wastewater utility

The Waste Water Utility PILOT could provide additional revenues to the City to offset special assessment revenues to fairly spread costs of street improvements to all properties (including tax-exempt entities) and create a stable revenue stream with minimal effort. The City currently receives a PILOT from Water Works and Lighting Commission (WWLC). The cost of PILOT payments are an effect of higher rates to utility ratepayers. The governing body that owns the utility has discretion on the appropriate amount of PILOT. Revenue Although the assessed value of the Wastewater Treatment Facility is not readily available, it would likely be comparable to the Water Utility with an equivalent computed tax (or PILOT) around $800,000. Pros

Cons

local sales tax

A local sales tax was considered as a possible option to research. The initial research concluded that the City of Wisconsin Rapids cannot enact a local sales tax. A county or state can create a sales tax, and in some cases, cities and villages that have been designated as “premier resort areas,” such as the Wisconsin Dells. |

We want to hear from City residents! After reading about the options, we asked residents to provide feedback. Which option do you think is best? Why? SURVEY RESULTS are now available! You may also email your alderperson or Mayor Shane Blaser. |